Maximizing Your Investments: A Comprehensive Guide to Understanding Dividend Yield

In the quest for financial growth, understanding yield yield of dividend can be a game changer. This simple yet powerful metric reveals how much cash investors can expect to earn from their stocks, offering insights into both potential income and overall investment health. Whether you’re a seasoned investor or just starting your financial journey, grasping the nuances of yield yield of dividend is essential to maximizing your investments. It’s not just about finding high-yield stocks; it’s about digging deeper into the sustainability and reliability of those dividends.

In this comprehensive guide, we’ll explore how yield yield of dividendworks, the factors that influence it, and strategies to effectively incorporate this crucial metric into your investment portfolio. Prepare to unlock the potential of your investments and make informed decisions that lead to long-term financial success. Let’s dive into the world of dividend yields and discover how to enhance your investment strategy today!

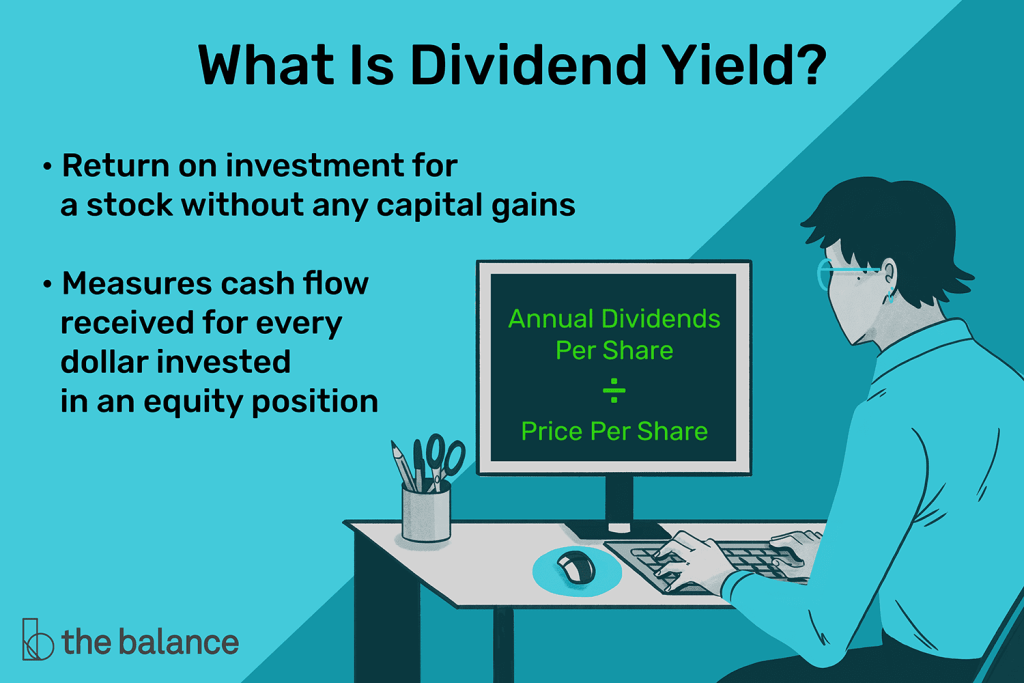

What is Dividend Yield?

Dividend yield is a financial ratio that measures how much a company pays in dividends annually relative to its stock price. Expressed as a percentage, it shows the return an investor earns from dividends alone, excluding capital gains. For example, a stock priced at $100 with $5 in annual dividends has a 5% yield. This metric is crucial for income-focused investors, especially retirees seeking steady cash flow.

Importance of Dividend Yield in Investment Strategy

Dividend yield helps investors assess income potential and risk. A stable yield often signals financial health, while unusually high yields may indicate undervalued stocks or underlying issues like declining share prices. It also aids in comparing income-generating assets across sectors, such as utilities (typically high yield) versus tech stocks (lower yield)。 Additionally, dividend-paying stocks historically outperform non-dividend stocks during market downturns, offering portfolio stability.

How to Calculate Dividend Yield

The basic formula is:

![]()

For instance, a stock paying $4 annually and trading at $80 has a 5% yield. Variations include:

Trailing Yield: Uses past 12-month dividends.

Forward Yield: Based on projected dividends.

30-Day Yield: Estimates short-term income using annualized dividends.

Types of Stocks with High Dividend Yields

1. Utilities: Regulated cash flows support consistent payouts (e.g., Duke Energy)。

2. REITs: Required to distribute 90% of taxable income (e.g., Realty Income yields ~4%)。

3. Consumer Staples: Brands like Coca-Cola offer stability and ~3% yields.

4. Energy Companies: Firms like ExxonMobil provide yields above 5%.

5. High-Yield ETFs: Funds like SDY focus on dividend aristocrats.

Factors Influencing Dividend Yield

Company Profitability: Sustained earnings enable dividend growth.

Interest Rates: Rising rates make bonds more attractive, pressuring dividend stocks.

Sector Trends: Cyclical industries (e.g., automotive) may cut dividends during downturns.

Payout Ratio: A ratio above 100% signals unsustainable dividends.

Market Sentiment: High demand for safe assets can inflate yields.

Risks Associated with High Dividend Yields

Dividend Cuts: Over 40% of S&P 500 companies reduced payouts during the 2008 crisis.

Interest Rate Sensitivity: Utility stocks often decline when rates rise.

Value Traps: A high yield might mask poor fundamentals (e.g., Altria’s 9% yield amid declining sales)。

Tax Inefficiency: Dividends are taxed as income, unlike capital gains.

Strategies for Investing in Dividend Stocks

1. Dividend Growth Investing: Focus on companies with 10+ years of payout increases (e.g., Johnson & Johnson)。

2. High-Yield Diversification: Balance REITs, utilities, and consumer staples to mitigate sector risks.

3. DRIPs (Dividend Reinvestment Plans): Compound returns by automatically buying more shares.

4. Yield-on-Cost Tracking: Monitor how initial yields grow over time (e.g., a 4% yield can become 8% if dividends double)。

5. Screening Tools: Use metrics like payout ratio (<75%) and debt-to-equity (<1.5) to filter sustainable payers.

Dividend Yield vs. Total Return: Understanding the Difference

Dividend yield focuses solely on income, while total return includes capital appreciation. For example, a stock with a 3% yield and 7% price rise delivers a 10% total return. Over time, companies like Procter & Gamble show that reinvested dividends can contribute 40%+ of total returns. However, high-yield stocks sometimes lag in growth (e.g., AT&T’s stagnant share price despite 7% yield)。

Conclusion: Making Informed Investment Decisions

Dividend yield is a powerful tool but requires context. Pair it with metrics like payout ratio, earnings growth, and sector trends. For balanced portfolios, blend high-yield stocks (e.g., REITs) with dividend growers (e.g., Microsoft)。 Always assess sustainability—companies like Coca-Cola, with 62 years of dividend hikes, exemplify reliability. By prioritizing quality and diversification, investors can harness dividends for both income and long-term wealth.