Decoding IndexBOM Sensex: Your Ultimate Guide to Understanding India’s Stock Market Trends

Welcome to the world of Indian finance, where the indexbom sensex acts as a barometer for market health and investor sentiment. Understanding this key index is essential for anyone looking to navigate the complexities of India’s stock market trends. From the fluctuations driven by economic shifts to the impact of global events, the Sensex offers valuable insights into market dynamics.

In this ultimate guide, we will unravel the intricacies of the IndexBOM Sensex, breaking down its components, the significance of its movements, and how you can leverage this knowledge to make informed investment decisions. Whether you’re a seasoned investor or just starting your journey, understanding the Sensex can empower you to anticipate trends, optimize your portfolio, and seize opportunities in the ever-evolving landscape of Indian stocks. Get ready to decode the Sensex and enhance your financial acumen!

The Importance of Sensex in the Indian Stock Market

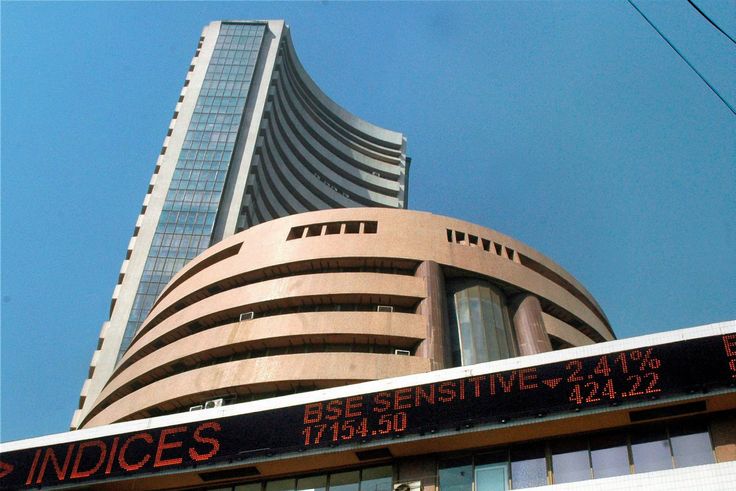

The BSE Sensex, India’s oldest and most widely tracked stock market index, serves as the heartbeat of the nation’s financial ecosystem. Comprising 30 of the largest and most liquid companies listed on the Bombay Stock Exchange (BSE), the Sensex reflects the collective performance of India’s corporate giants across sectors like banking, IT, energy, and consumer goods. For investors, it acts as a barometer of economic health, signaling trends in investor sentiment, economic growth, and policy impacts. A rising Sensex often correlates with bullish market conditions, while sharp declines—like the 1,300-point drop in October 2024—highlight vulnerabilities tied to geopolitical tensions or sector-specific shocks.

Moreover, the Sensex’s global recognition makes it a critical reference point for foreign institutional investors (FIIs) evaluating India’s growth story. Its movements influence capital flows, corporate valuations, and even policy decisions, cementing its role as a cornerstone of India’s financial markets.

How indexbom sensex is Calculated

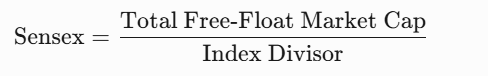

The Sensex uses a free-float market capitalization-weighted methodology, ensuring larger companies exert greater influence on the index. Here’s a breakdown:

1. Selection Criteria: Companies must rank among the top 75% by market cap and exhibit high liquidity.

2. Free-Float Adjustment: Only publicly traded shares (excluding promoter holdings) are considered.

3. Base Year: 1978–79 serves as the base period with a value of 100.

4. Formula:

The divisor ensures continuity despite corporate actions like stock splits. Regular reviews (every six months) maintain relevance, with adjustments for mergers, delistings, or liquidity changes.

Key Factors Influencing indexbom sensex Movements

1. Corporate Earnings: Weak quarterly results, such as HDFC Bank’s stagnant margins in December 2024, can trigger massive sell-offs.

2. Global Events: Geopolitical risks (e.g., Middle East conflicts) and U.S. Federal Reserve rate decisions impact FII inflows and risk appetite.

3. Domestic Policies: Pro-business reforms, RBI’s interest rate cuts, or fiscal stimulus (e.g., infrastructure spending) drive optimism.

4. Currency Fluctuations: A weaker rupee (e.g., ?83.15/USD in 2024) affects export-driven sectors like IT.

5. Commodity Prices: Crude oil volatility directly impacts energy-heavy indices like the Sensex.

Historical Trends and Performance of indexbom sensex

Since its 1986 launch, the Sensex has mirrored India’s economic evolution:

2011–2023: Surged from 19,000 to 60,000+ points, fueled by reforms, digitalization, and FDI inflows.

2024 Correction: Plunged 1,300 points due to HDFC Bank’s underperformance and Middle East tensions.

Long-Term Resilience: Despite short-term volatility, the Sensex delivered an 82% return over five years (2018–2023)。 Analysts project a 22–38% upside by 2025, targeting 93,000–105,000 points under favorable conditions.

Comparing Sensex with Other Stock Market Indices

| Index | Coverage | Key Traits |

|---|---|---|

| Sensex | 30 large-cap stocks | High liquidity, sectoral diversity 6 |

| Nifty 50 | 50 stocks (NSE) | Broader representation, higher volatility |

| S&P 500 | 500 U.S. companies | Tech-heavy, global benchmark 15 |

| Hang Seng | 50 Hong Kong stocks | China exposure, property-driven |

While the Sensex focuses on stability, the Nifty 50 offers broader market exposure. Globally, the S&P 500 and Germany’s DAX outperform in tech and manufacturing, respectively.

Investment Strategies for Trading in Sensex

1. Index Funds/ETFs: Mirror Sensex composition for passive exposure (e.g., HDFC Sensex ETF)。

2. Sector Rotation: Capitalize on cyclical trends (e.g., banking during rate cuts, IT during rupee depreciation)。

3. Dollar-Cost Averaging: Mitigate volatility by investing fixed amounts monthly.

4. Risk Management: Avoid leveraged derivatives—retail investors lost $21.6B in futures/options (2021–2024)。

Common Myths About Sensex Debunked

1. “Sensex = Entire Market”: It represents only 30 stocks, not 4,000+ BSE-listed companies.

2. “Short-Term Predictability”: Even AI-driven models struggle with daily swings influenced by global news.

3. “High Returns Guaranteed”: Long-term growth requires patience; 90% of retail traders lose money chasing quick gains.

Future Outlook: What to Expect from Sensex

Morgan Stanley’s 2025 bullish target (93,000 points) hinges on:

Macro Stability: Inflation control, fiscal discipline.

Private Investment Revival: Capex cycles in renewables and infrastructure.

Global Trade Shifts: Benefits from U.S.-India trade agreements and supply chain diversification.

Risks include oil price spikes, election uncertainty, and FII withdrawals. However, India’s structural reforms and demographic dividends position the Sensex for sustained growth.

Conclusion: Navigating the Indian Stock Market with Confidence

The Sensex remains a vital tool for decoding India’s equity landscape. By combining historical insights, sectoral analysis, and disciplined strategies—like index investing or ETF diversification—investors can harness its potential while mitigating risks. As global uncertainties persist, the Sensex’s resilience underscores India’s emergence as a 21st-century economic powerhouse. Stay informed, avoid impulsive trades, and focus on long-term wealth creation to thrive in this dynamic market.